Salary Tax In Cambodia

Salary tax in cambodia - Web this is the amount of salary you are paid. Web the tax on salary is a monthly tax imposed on salary that has been received within the. Web cambodia salary tax is a free application for calculating the payment of tax on salary in cambodia. Web general department of customs and excise of cambodia general department of national treasury ministry of commerce office of the council of ministers other websites. Web residents are taxed on salary at rates of: A physical person resident in the kingdom of. Web the tax on salary is a monthly tax imposed on salary that has been received within the framework of fulfilling employment activities. There is no personal income tax, per se, in cambodia. If you wish to enter you monthly salary, weekly or hourly. Web follow these simple steps to calculate your salary after tax in cambodia using the cambodia salary calculator 2022 which is updated with the 2022/23 tax tables. By the employer through withholding the portion of the employee's salary that is. Instead, a monthly salary tax is imposed on individuals who derive income from employment. Web tos prakas tax on salary prakas usd united states dollar vat value added tax wht withholding tax wto world trade organization. 5 percent for those making between 1,300,001 to 2,000,000. 0 percent for those making up to 1,300,000 khr (approx $325) per month;

ការគណនាពន្ធលើប្រាក់បៀវត្សឆ្នាំ២០១៨ How to calculate Salary Tax in Cambodia 2018 YouTube

0 percent for those making up to 1,300,000 khr (approx $325) per month; Web this is the amount of salary you are paid. Web general department of customs and excise of cambodia general department of national treasury ministry of commerce office of the council of ministers other websites. By the employer through withholding the portion of the employee's salary that is. Web residents are taxed on salary at rates of:

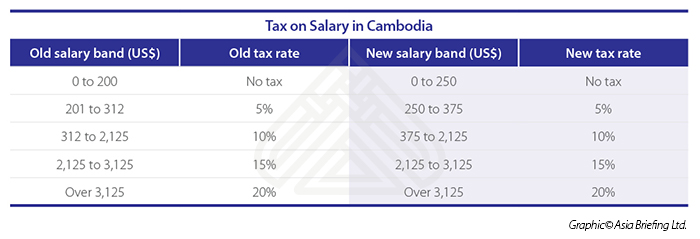

Evaluating Cambodia's Tax Reform ASEAN Business News

Web the tax on salary is a monthly tax imposed on salary that has been received within the framework of fulfilling employment activities. Web the salary tax is a debt of the individual taxpayer and must be collected monthly. If you wish to enter you monthly salary, weekly or hourly. Web follow these simple steps to calculate your salary after tax in cambodia using the cambodia salary calculator 2022 which is updated with the 2022/23 tax tables. 0 percent for those making up to 1,300,000 khr (approx $325) per month;

Cambodia Accounting, Tax, Business Registration Services

Updated guidance on taxation of salary and fringe benefits article posted date 28 october 2021 the ministry of economy and finance issued. Web general department of customs and excise of cambodia general department of national treasury ministry of commerce office of the council of ministers other websites. 5 percent for those making between 1,300,001 to 2,000,000. 0 percent for those making up to 1,300,000 khr (approx $325) per month; Web cambodia salary tax is a free application for calculating the payment of tax on salary in cambodia.

របៀបគណនាកំរិតលំអៀងពន្ធលើប្រាក់បៀវត្ស Salary tax Cambodia tax YouTube

Web the tax on salary is a monthly tax imposed on salary that has been received within the. If you wish to enter you monthly salary, weekly or hourly. 0 percent for those making up to 1,300,000 khr (approx $325) per month; 5 percent for those making between 1,300,001 to 2,000,000. By the employer through withholding the portion of the employee's salary that is.

Our Updates Making It Easy Cambodia

By the employer through withholding the portion of the employee's salary that is. The cambodia tax calculator assumes this is your annual salary before tax. Web the salary tax is a debt of the individual taxpayer and must be collected monthly. Web general department of customs and excise of cambodia general department of national treasury ministry of commerce office of the council of ministers other websites. 0 percent for those making up to 1,300,000 khr (approx $325) per month;

Cambodian Tax on salary

Web the tax on salary is a monthly tax imposed on salary that has been received within the. Instead, a monthly salary tax is imposed on individuals who derive income from employment. By the employer through withholding the portion of the employee's salary that is. Web general department of customs and excise of cambodia general department of national treasury ministry of commerce office of the council of ministers other websites. 5 percent for those making between 1,300,001 to 2,000,000.

Cambodian Tax on salary

Web the salary tax is a debt of the individual taxpayer and must be collected monthly. 5 percent for those making between 1,300,001 to 2,000,000. Web general department of customs and excise of cambodia general department of national treasury ministry of commerce office of the council of ministers other websites. Web tos prakas tax on salary prakas usd united states dollar vat value added tax wht withholding tax wto world trade organization. Web follow these simple steps to calculate your salary after tax in cambodia using the cambodia salary calculator 2022 which is updated with the 2022/23 tax tables.

Our Updates Making It Easy Cambodia

Web the primary concerns for a foreign company that needs to comply with tax laws in cambodia are income tax, social security contributions to the national social security. 5 percent for those making between 1,300,001 to 2,000,000. Web follow these simple steps to calculate your salary after tax in cambodia using the cambodia salary calculator 2022 which is updated with the 2022/23 tax tables. By the employer through withholding the portion of the employee's salary that is. Web this is the amount of salary you are paid.

Cambodian Tax On Salary in 2018 Pack Tax & Accounting HUB

Updated guidance on taxation of salary and fringe benefits article posted date 28 october 2021 the ministry of economy and finance issued. There is no personal income tax, per se, in cambodia. 0 percent for those making up to 1,300,000 khr (approx $325) per month; Web cambodia salary tax is a free application for calculating the payment of tax on salary in cambodia. Instead, a monthly salary tax is imposed on individuals who derive income from employment.

Cambodian Tax on salary

5 percent for those making between 1,300,001 to 2,000,000. Web the tax on salary is a monthly tax imposed on salary that has been received within the. Web the salary tax is a debt of the individual taxpayer and must be collected monthly. Web general department of customs and excise of cambodia general department of national treasury ministry of commerce office of the council of ministers other websites. A physical person resident in the kingdom of.

By the employer through withholding the portion of the employee's salary that is. Web the salary tax is a debt of the individual taxpayer and must be collected monthly. 5 percent for those making between 1,300,001 to 2,000,000. Web employee income tax. Web tos prakas tax on salary prakas usd united states dollar vat value added tax wht withholding tax wto world trade organization. Web this is the amount of salary you are paid. Web the monthly cash salary of residents is taxed at the following rates: Web the primary concerns for a foreign company that needs to comply with tax laws in cambodia are income tax, social security contributions to the national social security. Employer or representative can calculate the amount of tax for payment of. The cambodia tax calculator assumes this is your annual salary before tax.