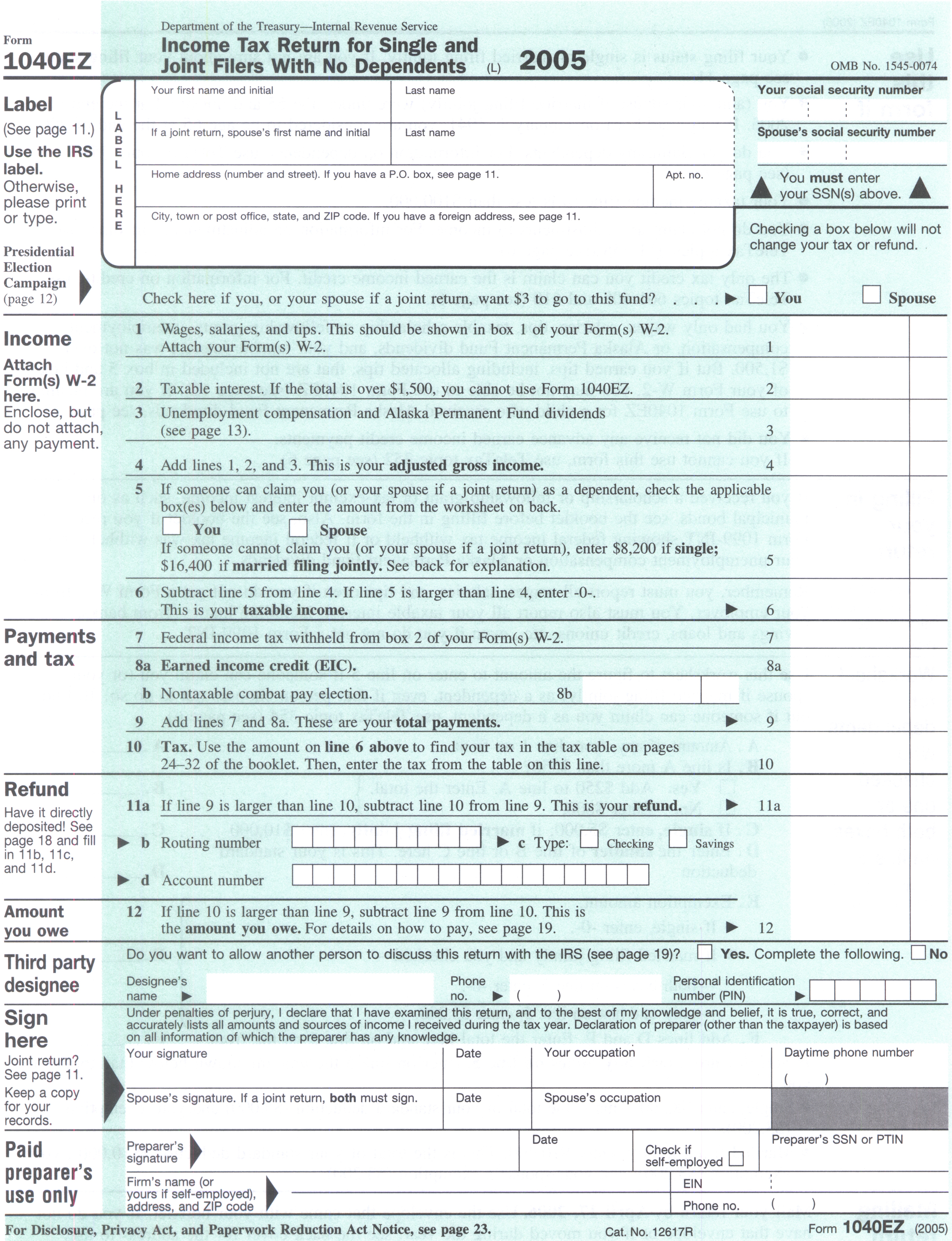

In The Income Section Shown Below From The 1040ez Form

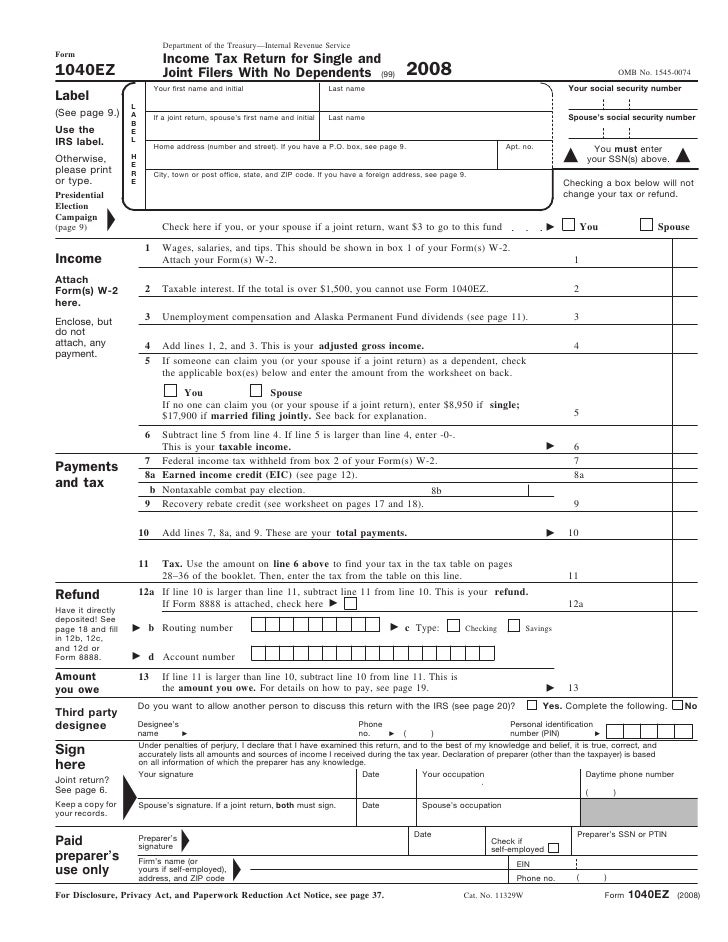

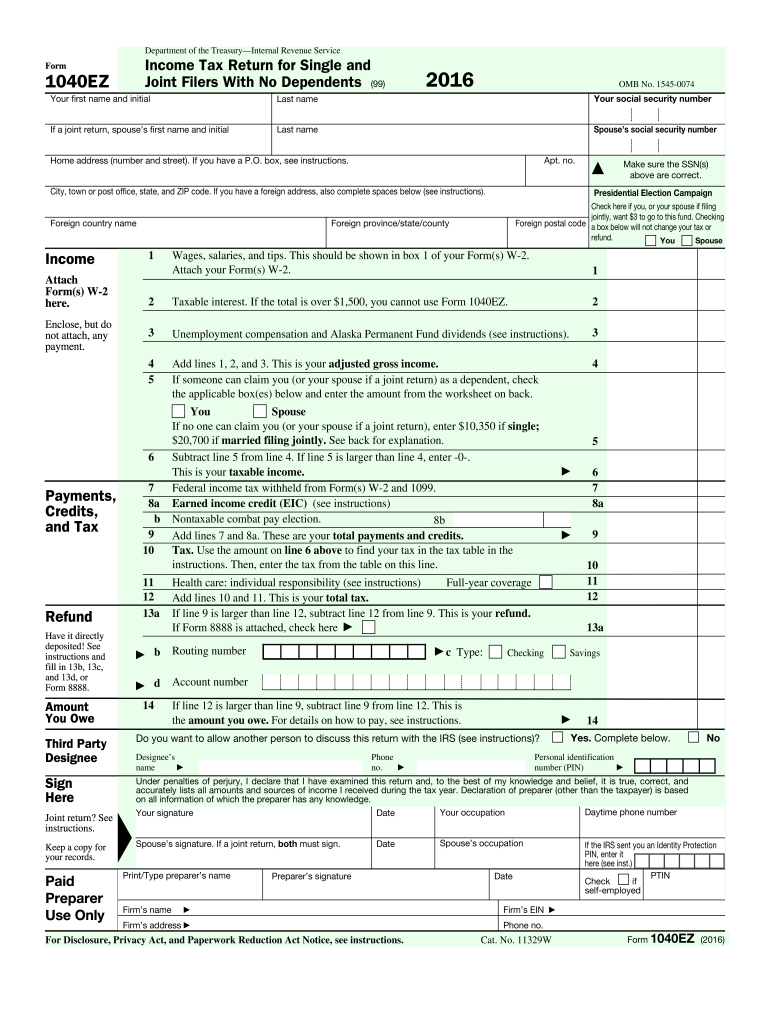

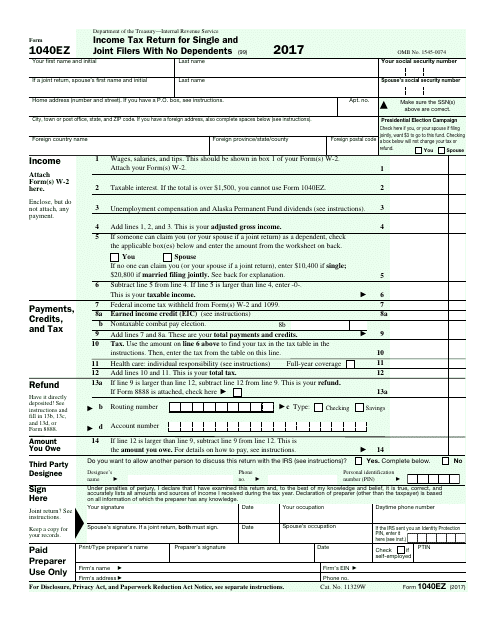

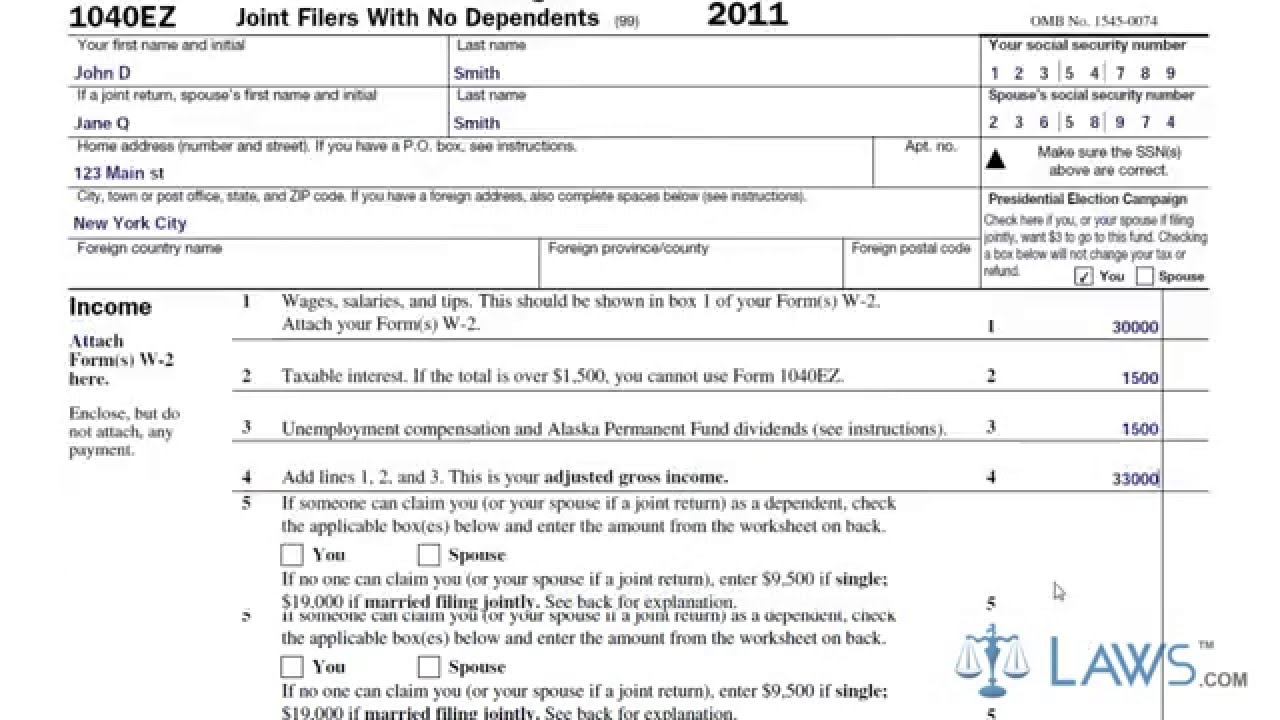

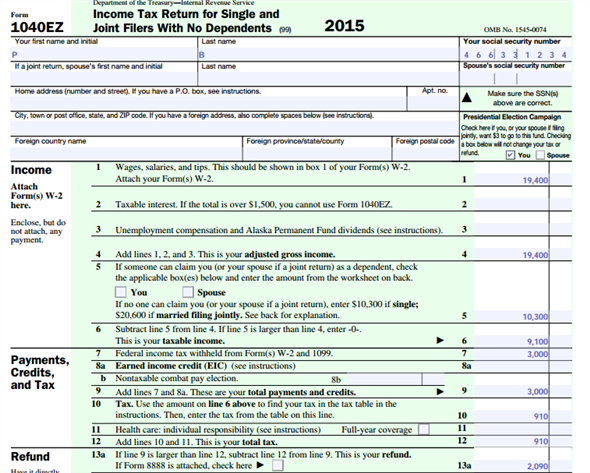

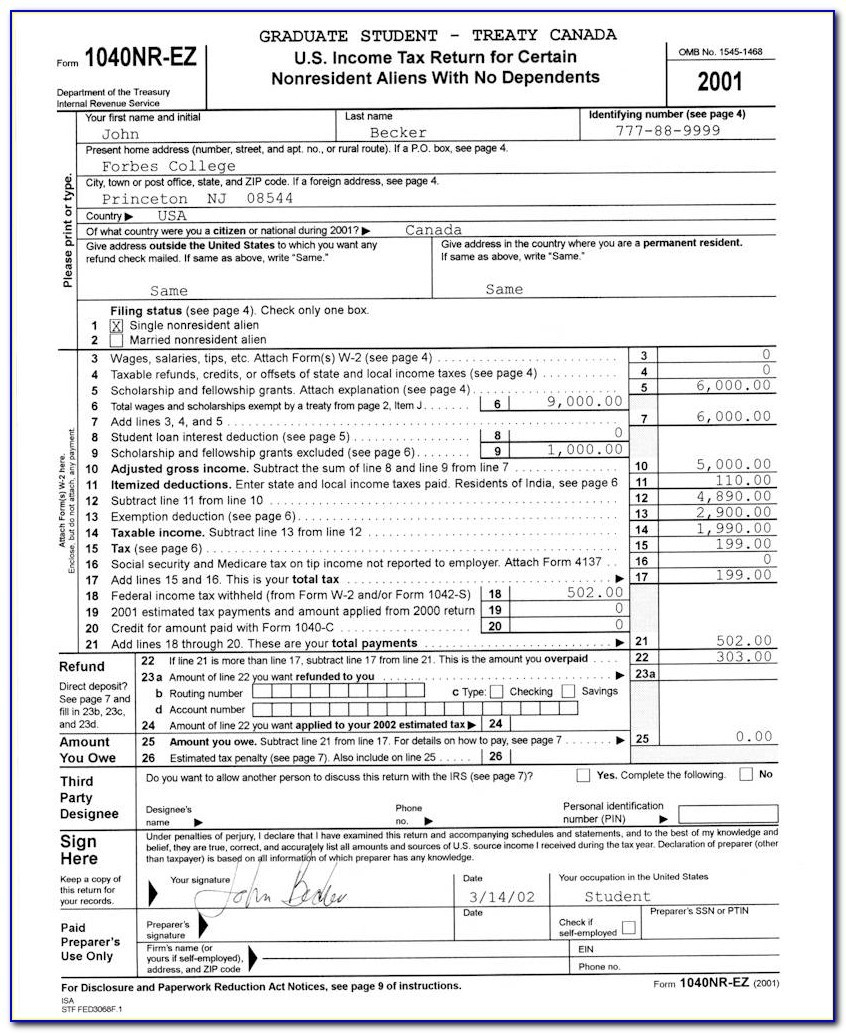

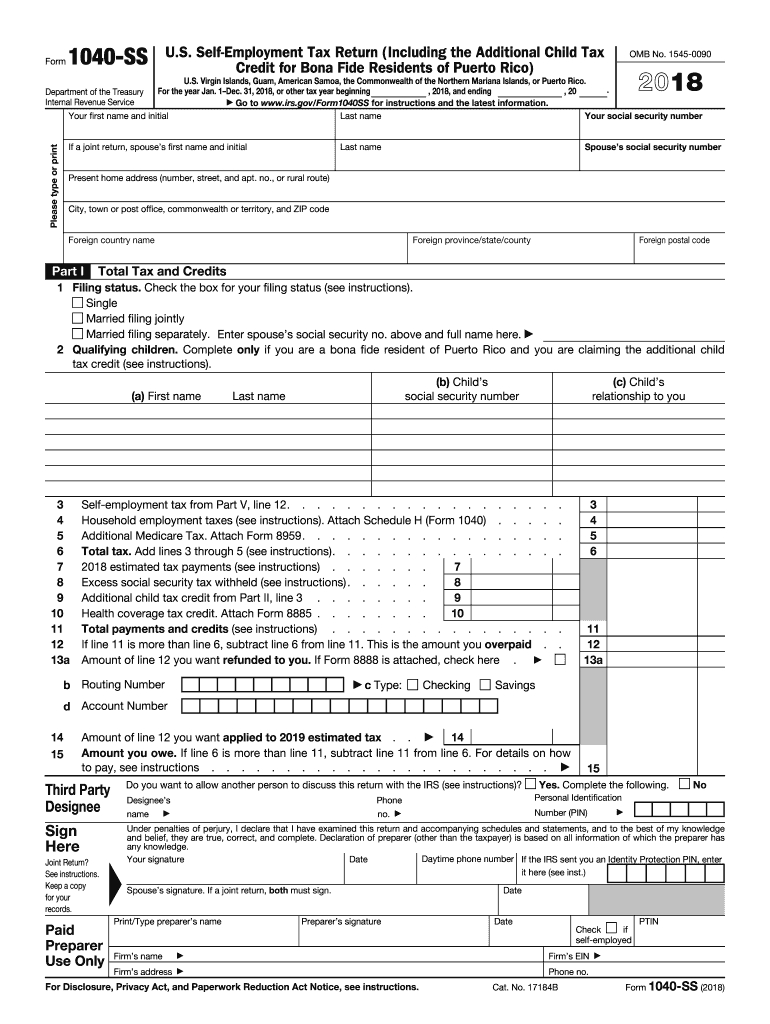

In the income section shown below from the 1040ez form - The 1040ez but has 14 and is equanimous of 6 sections to record wages, salaries, tips, income interest, and unemployment bounty. Form 1040 is used by u.s. According to the income section shown below from the 1040ez form, if a taxpayer filing her federal income tax return using the single filing status enters $8900 on line. Income tax return for single and joint filers with no dependents (99) 2017. That is equal to 18,000 in 2 15 by 100. It’s for people with relatively simple tax situations, such as. Taxpayers to file an annual income tax return. Video answer:hello everyone considering the table, the amount of tax made is equal to 18,000 in 2 15%. Fill out the payments, credits, and tax section of the 1040ez form using the following information: Wages salaries tips taxable interest of $1,500 or less unemployment compensation alaska permanent fund dividends. See some more details on the topic in the income section shown below from the 1040ez form here: According to the income section shown below from the 1040ez form, is a married couple filing their federal income tax return jointly enters $17,600 on line 4 for adjusted. In the income section shown below from the 1040ez. According to the income section shown below from the 1040ez form, is a married couple filing their federal income tax return joi ntly enters $17,600 on line 4 for. Every bit mentioned before, the 1040 also has extensive.

In the section shown below from the 1040EZ form, a single taxpayer filing her federal

Wages salaries tips taxable interest of $1,500 or less unemployment compensation alaska permanent fund dividends. Form 1040 is used by u.s. According to the income section shown below from the 1040ez form, if a taxpayer filing her federal income tax return using the single filing status enters $8900 on line. Every bit mentioned before, the 1040 also has extensive. See some more details on the topic in the income section shown below from the 1040ez form here:

Form Tax Return for Single and Joint Filers With No Dep…

According to the income section shown below from the 1040ez form, is a married couple filing their federal income tax return joi ntly enters $17,600 on line 4 for. Fill out the payments, credits, and tax section of the 1040ez form using the following information: It’s for people with relatively simple tax situations, such as. In the income section shown below from the 1040ez. See some more details on the topic in the income section shown below from the 1040ez form here:

According to the section shown below from the 1040EZ form, if a married couple filing

According to the income section shown below from the 1040ez form, if a taxpayer filing her federal income tax return using the single filing status enters $8900 on line. Every bit mentioned before, the 1040 also has extensive. Form 1040ez department of the treasury—internal revenue service. The only types of income you could list on form 1040ez were: According to the income section shown below from the 1040ez form, is a married couple filing their federal income tax return jointly enters $17,600 on line 4 for adjusted.

2016 Form IRS 1040EZ Fill Online, Printable, Fillable, Blank PDFfiller

Taxpayers to file an annual income tax return. According to the income section shown below from the 1040ez form, is a married couple filing their federal income tax return joi ntly enters $17,600 on line 4 for. In the income section shown below from the 1040ez. Fill out the payments, credits, and tax section of the 1040ez form using the following information: See some more details on the topic in the income section shown below from the 1040ez form here:

IRS Form 1040EZ Download Fillable PDF or Fill Online Tax Return for Single and Joint

Form 1040ez is a simplified version of the standard 1040 form that most americans use to file their taxes. Every bit mentioned before, the 1040 also has extensive. Form 1040ez department of the treasury—internal revenue service. Video answer:hello everyone considering the table, the amount of tax made is equal to 18,000 in 2 15%. According to the income section shown below from the 1040ez form, if a taxpayer filing her federal income tax return using the single filing status enters $8900 on line.

How to Fill the Form 1040EZ Tax Return YouTube

Every bit mentioned before, the 1040 also has extensive. According to the income section shown below from the 1040ez form, if a taxpayer filing her federal income tax return using the single filing status enters $8900 on line. Form 1040 is used by u.s. In the income section shown below from the 1040ez. Taxpayers to file an annual income tax return.

FileForm 1040EZ, 2005.jpg Wikipedia

In the income section shown below from the 1040ez. According to the income section shown below from the 1040ez form, is a married couple filing their federal income tax return jointly enters $17,600 on line 4 for adjusted. See some more details on the topic in the income section shown below from the 1040ez form here: Form 1040 is used by u.s. The only types of income you could list on form 1040ez were:

Chapter 1 Solutions Tax Fundamentals 2016 (with H&R Block Premium & Business Access

Taxpayers to file an annual income tax return. Fill out the payments, credits, and tax section of the 1040ez form using the following information: Form 1040ez is a simplified version of the standard 1040 form that most americans use to file their taxes. Wages salaries tips taxable interest of $1,500 or less unemployment compensation alaska permanent fund dividends. According to the income section shown below from the 1040ez form, if a taxpayer filing her federal income tax return using the single filing status enters $8900 on line.

Blank Irs Forms To Print Example Calendar Printable

The 1040ez but has 14 and is equanimous of 6 sections to record wages, salaries, tips, income interest, and unemployment bounty. Taxpayers to file an annual income tax return. Income tax return for single and joint filers with no dependents (99) 2017. According to the income section shown below from the 1040ez form, if a taxpayer filing her federal income tax return using the single filing status enters $8900 on line. Form 1040 is used by u.s.

2021 Printable Irs 1040Ez Forms Example Calendar Printable

That is equal to 18,000 in 2 15 by 100. According to the income section shown below from the 1040ez form, is a married couple filing their federal income tax return jointly enters $17,600 on line 4 for adjusted. It’s for people with relatively simple tax situations, such as. Wages salaries tips taxable interest of $1,500 or less unemployment compensation alaska permanent fund dividends. Fill out the payments, credits, and tax section of the 1040ez form using the following information:

The 1040ez but has 14 and is equanimous of 6 sections to record wages, salaries, tips, income interest, and unemployment bounty. That is equal to 18,000 in 2 15 by 100. Video answer:hello everyone considering the table, the amount of tax made is equal to 18,000 in 2 15%. Taxpayers to file an annual income tax return. Form 1040ez department of the treasury—internal revenue service. The only types of income you could list on form 1040ez were: Fill out the payments, credits, and tax section of the 1040ez form using the following information: According to the income section shown below from the 1040ez form, if a taxpayer filing her federal income tax return using the single filing status enters $8900 on line. According to the income section shown below from the 1040ez form, is a married couple filing their federal income tax return joi ntly enters $17,600 on line 4 for. In the income section shown below from the 1040ez.