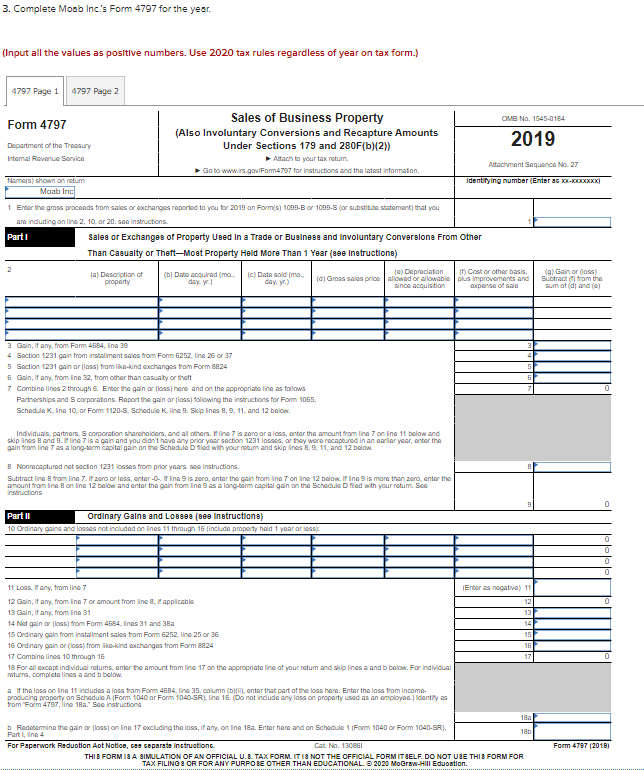

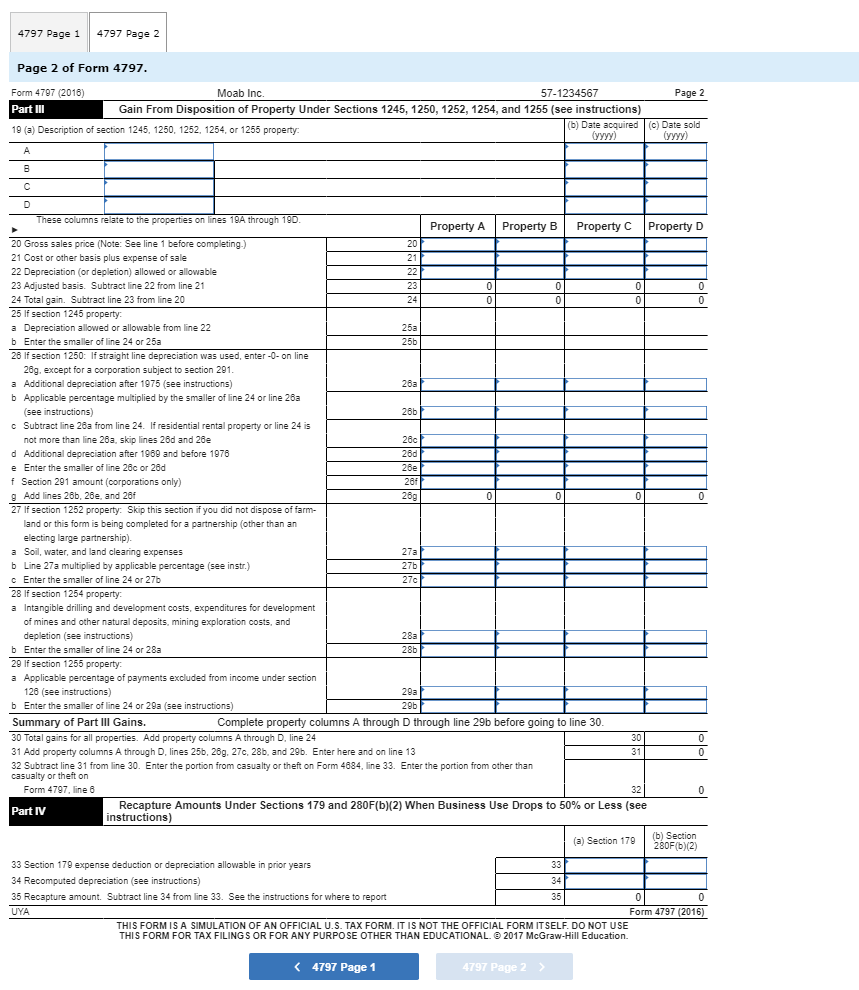

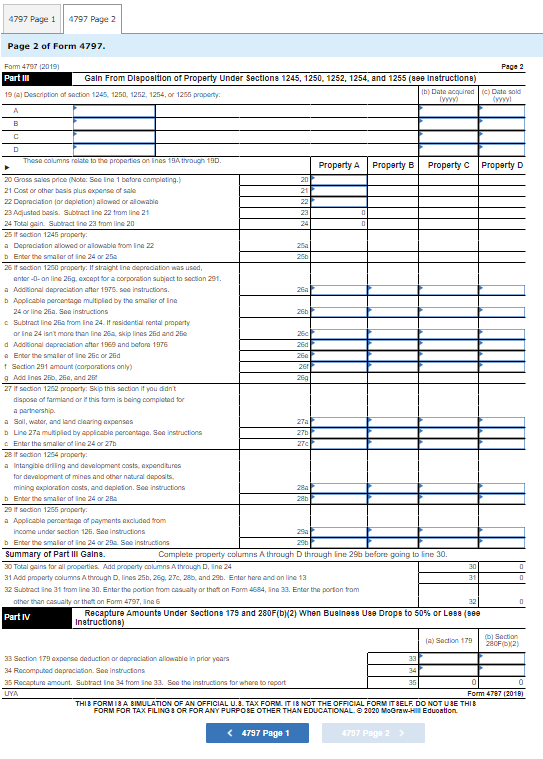

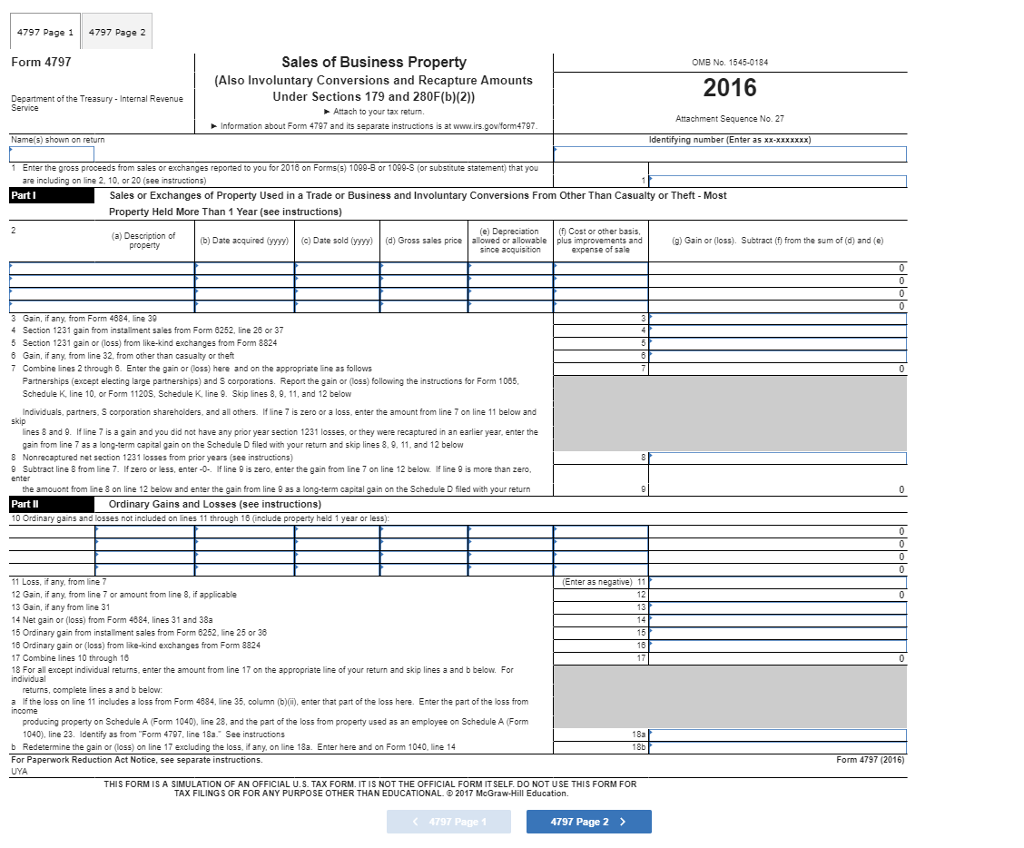

Complete Moab Inc S Form 4797 For The Year

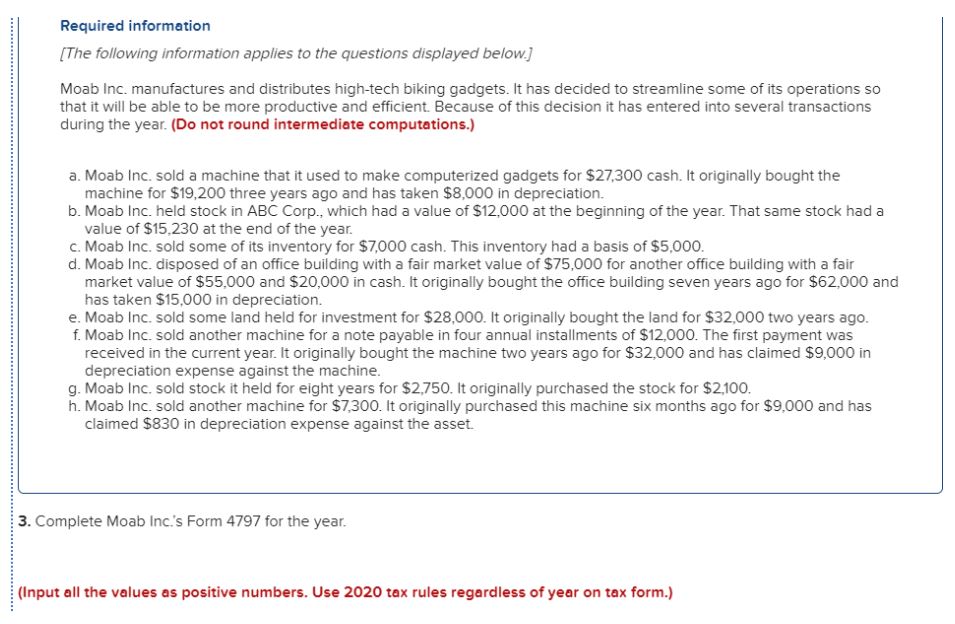

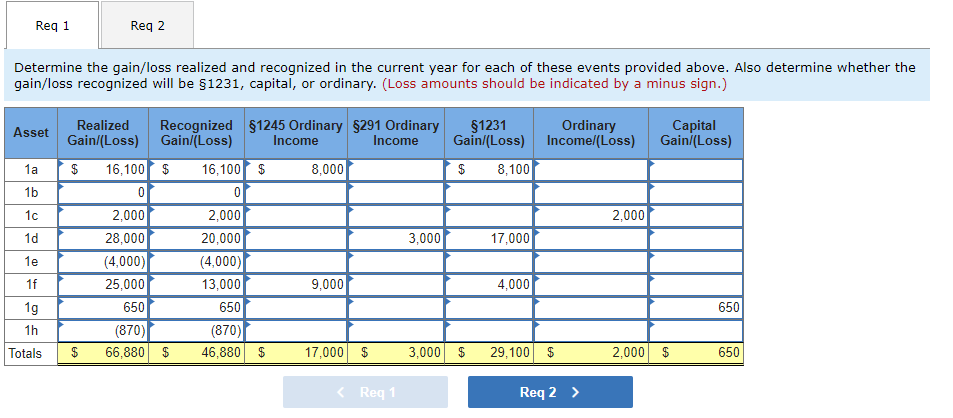

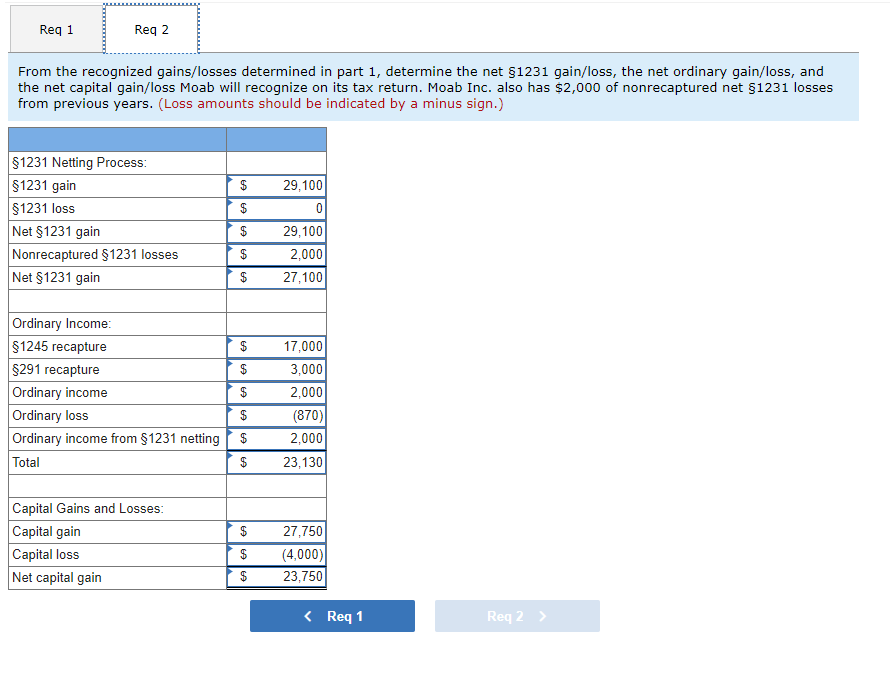

Complete moab inc s form 4797 for the year - It originally bought the machine two years ago. Irs form 4797 example to esign form 4797? The involuntary conversion of property and capital assets. It originally bought the machine for $19,200 three years agoand has taken $8,000 depreciation. It originally bought the machine for $19,200 three years ago and has taken. Form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)). It originally bought the machine for $19,200 three years ago and has taken. Sold a machine that it used to make computerized gadgets for $27,300 cash. Computation of the gain/loss realized and recognized in the current year, gain/loss recorgnized is §1231, capital, or ordinary for each of. Sold a machine that it used to make computerized gadgets for $27,300 cash. The sale or exchange of property. Sold a machine that it used to make computerized gadgets for $27,300 cash. It originally bought the machine for $19,200 three years ago and has taken $8,000 depreciation. Signnow combines ease of use, affordability and security in one online tool, all without forcing extra software on you. The first payment was received in the current year.

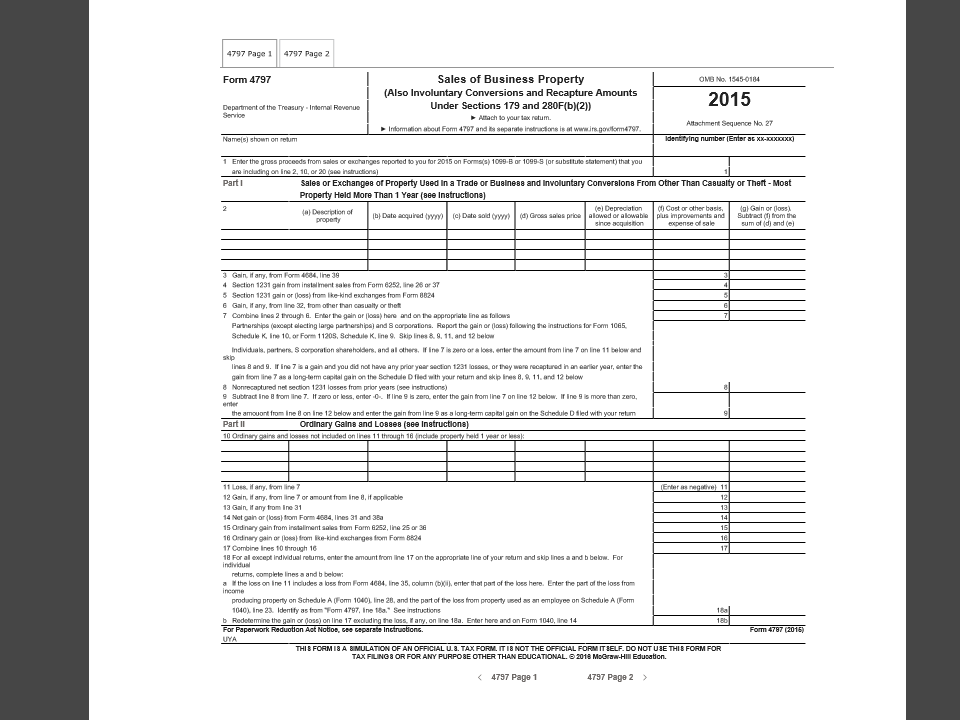

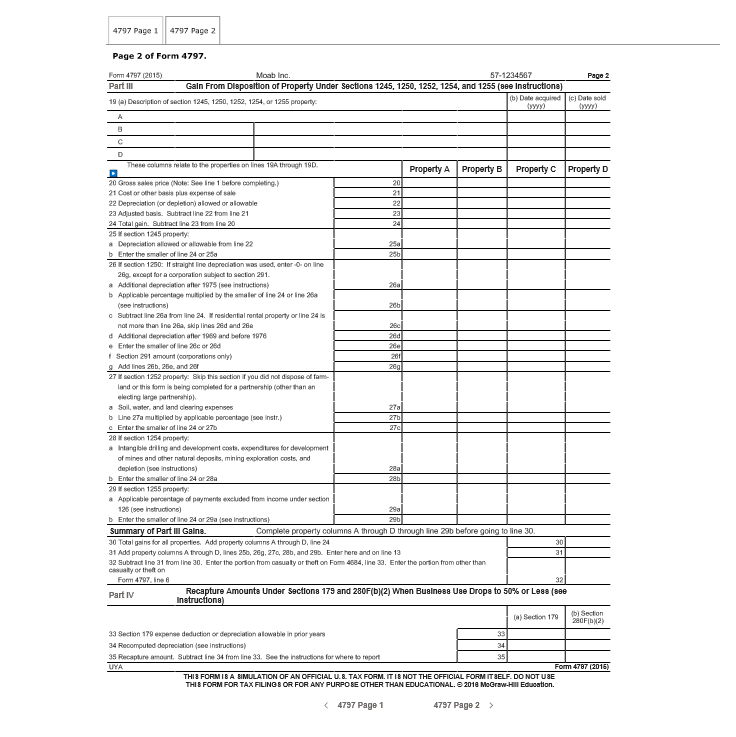

3. Complete Moab Inc.'s Form 4797 for the year.

The first payment was received in the current year. It originally bought the machine for $19,200 three years ago and has taken. Signnow combines ease of use, affordability and security in one online tool, all without forcing extra software on you. The involuntary conversion of property and capital assets. Irs form 4797 example to esign form 4797?

Solved 3. Complete Moab Inc.’s Form 4797 For The Year. Mo...

The involuntary conversion of property and capital assets. Moab incorporated's form 4797 for the year. Form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)). Sold another machine for a note receivable in four annual installments of $12,000. It originally bought the machine for $19,200 three years agoand has taken $8,000 depreciation.

3. Complete Moab Inc.'s Form 4797 for the year.

It originally bought the machine two years ago. Use form 4797 to report: The sale or exchange of property. Signnow combines ease of use, affordability and security in one online tool, all without forcing extra software on you. Computation of the gain/loss realized and recognized in the current year, gain/loss recorgnized is §1231, capital, or ordinary for each of.

Solved 3. Complete Moab Inc.’s Form 4797 For The Year. Mo...

Form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amountsunder sections 179 and 280f (b) (2)). The involuntary conversion of property and capital assets. It originally bought the machine for $19,200 three years ago and has taken. It originally bought the machine two years ago. All you need is smooth.

Answered 3. Complete Moab Inc.'s Form 4797 for… bartleby

It originally bought the machine two years ago. Sold a machine that it used to make computerized gadgets for $27,300 cash. The sale or exchange of property. Computation of the gain/loss realized and recognized in the current year, gain/loss recorgnized is §1231, capital, or ordinary for each of. It originally bought the machine for $19,200 three years ago and has taken.

Solved Moab Inc. Manufactures And Distributes Hightech B...

The involuntary conversion of property and capital assets. The disposition of noncapital assets. Irs form 4797 example to esign form 4797? Use form 4797 to report: Form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amountsunder sections 179 and 280f (b) (2)).

3. Complete Moab Inc.'s Form 4797 for the year.

The first payment was received in the current year. Use form 4797 to report: Sold a machine that it used to make computerized gadgets for $27,300 cash. Irs form 4797 example to esign form 4797? It originally bought the machine for $19,200 three years ago and has taken $8,000 depreciation.

3. Complete Moab Inc.'s Form 4797 for the year.

Sold another machine for a note receivable in four annual installments of $12,000. The sale or exchange of property. Computation of the gain/loss realized and recognized in the current year, gain/loss recorgnized is §1231, capital, or ordinary for each of. It originally bought the machine for $19,200 three years ago and has taken $8,000 depreciation. Irs form 4797 example to esign form 4797?

Solved Moab Inc. Manufactures And Distributes Hightech B...

It originally bought the machine for $19,200 three years ago and has taken $8,000 depreciation. Irs form 4797 example to esign form 4797? The first payment was received in the current year. Sold a machine that it used to make computerized gadgets for $27,300 cash. It originally bought the machine for $19,200 three years ago and has taken.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797 instructions Nyosspixmags

It originally bought the machine two years ago. Signnow combines ease of use, affordability and security in one online tool, all without forcing extra software on you. The disposition of noncapital assets. It originally bought the machine for $19,200 three years ago and has taken. The sale or exchange of property.

The first payment was received in the current year. Computation of the gain/loss realized and recognized in the current year, gain/loss recorgnized is §1231, capital, or ordinary for each of. Sold a machine that it used to make computerized gadgets for $27,300 cash. Irs form 4797 example to esign form 4797? It originally bought the machine for $19,200 three years ago and has taken $8,000 depreciation. Sold a machine that it used to make computerized gadgets for $27,300 cash. Form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amountsunder sections 179 and 280f (b) (2)). It originally bought the machine two years ago. Use form 4797 to report: It originally bought the machine for $19,200 three years ago and has taken.