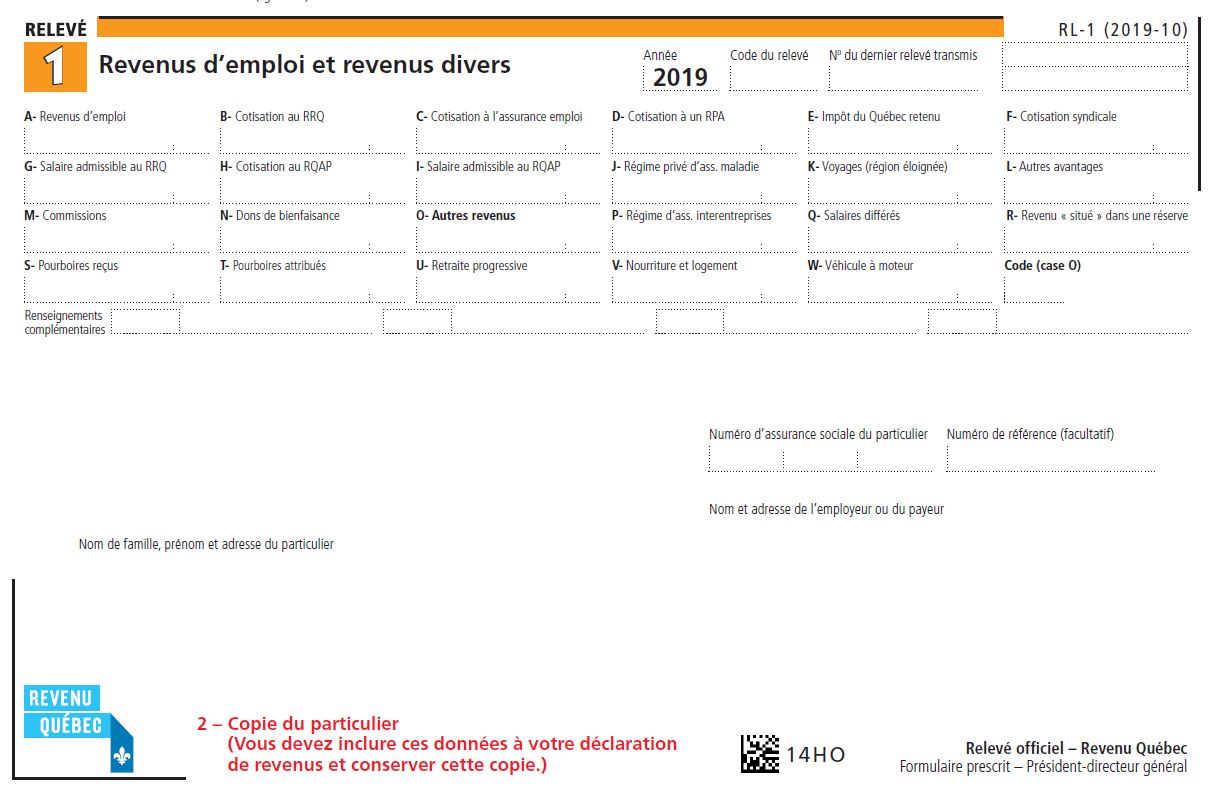

Canada Rl 1 Form

Canada rl 1 form - Web the relevé 1 slip (available in french only) must be filed by any employer or payer that paid salaries, wages, gratuities, tips, fees, scholarships, commissions or other amounts to an. Web the relevé 1 slip (available in french only) must be filed by any employer or payer that paid salaries, wages, gratuities, tips, fees, scholarships, commissions or other amounts to an. Our business partners are interested. Web you’ll receive a relevé 1: Engaged parties names, places of residence and numbers etc. Follow the simple instructions below: Open it using the online editor and begin altering. This slip shows your income as well as any deductions from. Web get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. In a matter of seconds, receive an electronic document with. If you have stopped making periodic. Source deductions and employer contributions. Web how to edit your rl 1 fillable form 2020 online with efficiency.

SimpleTax Help How do I report my RL1 from Quebec?

Source deductions and employer contributions. Web the relevé 1 slip (available in french only) must be filed by any employer or payer that paid salaries, wages, gratuities, tips, fees, scholarships, commissions or other amounts to an. Web the relevé 1 slip (available in french only) must be filed by any employer or payer that paid salaries, wages, gratuities, tips, fees, scholarships, commissions or other amounts to an. Enjoy smart fillable fields and interactivity. In a matter of seconds, receive an electronic document with.

Payroll YearEnd 2018 The Definitive Guide by Avanti Software

Source deductions and employer contributions. Web get your online template and fill it in using progressive features. If you have stopped making periodic. Enjoy smart fillable fields and interactivity. Our business partners are interested.

releve 1 summary rl 1 fillable form TURJN

Follow the simple instructions below: In a matter of seconds, receive an electronic document with. This slip shows your income as well as any deductions from. Web the relevé 1 slip (available in french only) must be filed by any employer or payer that paid salaries, wages, gratuities, tips, fees, scholarships, commissions or other amounts to an. Engaged parties names, places of residence and numbers etc.

The Canadian Employee's Guide to Payroll YearEnd Avanti Software

Engaged parties names, places of residence and numbers etc. Source deductions and employer contributions. Open it using the online editor and begin altering. Our business partners are interested. Web get your online template and fill it in using progressive features.

Sample Forms

In a matter of seconds, receive an electronic document with. Open it using the online editor and begin altering. Web you’ll receive a relevé 1: Source deductions and employer contributions. Our business partners are interested.

PPT to Canada International Students PowerPoint Presentation ID9328428

Web how to edit your rl 1 fillable form 2020 online with efficiency. This slip shows your income as well as any deductions from. Our business partners are interested. Engaged parties names, places of residence and numbers etc. Open it using the online editor and begin altering.

SimpleTax Help How do I report my RL1 from Québec?

Open it using the online editor and begin altering. If you have stopped making periodic. Web how to edit your rl 1 fillable form 2020 online with efficiency. In a matter of seconds, receive an electronic document with. Follow the simple instructions below:

Creating T4, T4A and RL1 tax slips PaymentEvolution Support

Our business partners are interested. In a matter of seconds, receive an electronic document with. Source deductions and employer contributions. Web you’ll receive a relevé 1: Engaged parties names, places of residence and numbers etc.

The Canadian Employee's Guide to Payroll YearEnd Avanti Software

In a matter of seconds, receive an electronic document with. Source deductions and employer contributions. Follow the simple instructions below: Web you’ll receive a relevé 1: Engaged parties names, places of residence and numbers etc.

Canadian Tax Software News Latest Information AvanTax eForms

Web the relevé 1 slip (available in french only) must be filed by any employer or payer that paid salaries, wages, gratuities, tips, fees, scholarships, commissions or other amounts to an. Web how to edit your rl 1 fillable form 2020 online with efficiency. Engaged parties names, places of residence and numbers etc. Open it using the online editor and begin altering. Web you’ll receive a relevé 1:

Follow the simple instructions below: Web you’ll receive a relevé 1: Open it using the online editor and begin altering. Web the relevé 1 slip (available in french only) must be filed by any employer or payer that paid salaries, wages, gratuities, tips, fees, scholarships, commissions or other amounts to an. Web how to edit your rl 1 fillable form 2020 online with efficiency. Engaged parties names, places of residence and numbers etc. If you have stopped making periodic. In a matter of seconds, receive an electronic document with. This slip shows your income as well as any deductions from. Web the relevé 1 slip (available in french only) must be filed by any employer or payer that paid salaries, wages, gratuities, tips, fees, scholarships, commissions or other amounts to an.